MTA: Where we buy marine electronics

The MTA 2011 Survey is still underway. In fact, we could really use more responses. Yes, we're running it a bit later this year, and boating season has begun for many, but remember the goal of helping marine electronics manufacturers and distributors to better understand what we want and how we buy stuff. Your response, for instance, might help to confirm or modify the following MTA analysis of which sources are on the rise, and which aren't...

To-date, MTA has captured nearly 1,400 survey responses from marine electronics users. One of the key areas of focus of the survey is sources of supply. The survey asks users:

1. How they select their sources of supply

2. How their sources are performing, and

3. For specific comments on their recent experiences with current sources

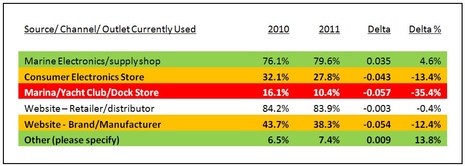

The table below highlights which channels, or sources of supply, users are purchasing from and how their preferred sources have changed during the past year.

1. Plummeting Share -- Marina/ yacht club/ dock stores. Why? Well, according to our surveys, and the comments provided by respondents, this channel offers hellaciously high prices, generally uneven service, limited selection and long lead times for out of stock.

2. Declining Share - Consumer Electronics Stores (CES) and Supplier Websites. Two different stories here.

- CES. This channel share had been growing during the past few years, especially with GPS, mobile computing and communications platforms and some house and entertainment systems categories. However, according to the comments in our database, CES support is generally very weak, and the pricing, no longer as competitive as other channels.

- Supplier WebSites. Decline in this channel as a source of supply has been going on since at least 2009. There are a number of factors cited for this, incuding too much promotional information, not enough technical information, and uneven pricing.

3. Stable Share - Marine Electronics Retailer/ Wholesaler websites. Survey respondents cite the broad selection, brand comparison capabilities, price and delivery as their strongest points. These are the preferred channels for mid-range price/ complexity purchases.

4. Growing share - Marine Electronics Supply Shop. With an already high rate of response 76.1%, use of this channel grew 4.6% in relative terms to 79.1%. Why? Because it generally delivers convenience or expertise, some both. From contigency purchases, to planned evaluation, test and rollout of complex systems, these channels are providing more value, and winning more business.

5. Rapidly Growing Share - Other Sources/ Broad-Line Web Retailers. A number of factors are combining to arrive the marine electronics at a place where broad-line retailers, especially Amazon based on the number of citations, are gaining share in the recreational marine electronics market. Key point: Service expectations are low, purchases are concentrated in commodities, simple components and less complex solutions.

- Commercial and consumer grade mobile devices on boats

- Broader collection of GPS options, application and deployments

- Amazon's growing collection of offerings in these categories

- Competitive pricing

- Reliability, aggressive delivery options

What is the Point?

Changes in purchasing sources are powerful indicators of a number of trends in the recreational marine electronics market. A number of stakeholder groups - from users all the way through vendors of enabling technologies to marine electronics suppliers -- can benefit from considered application of this data. Please consider taking the survey, or recommending colleagues to take the survey. -- Marine Technology Advisors

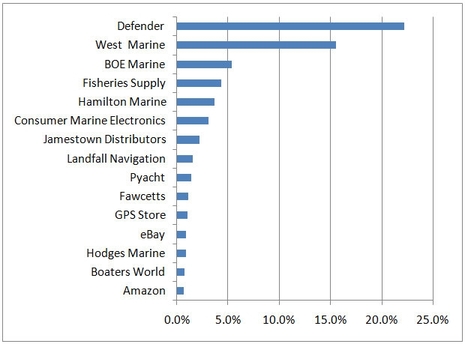

PS There's a place in the survey where respondents can write in up to three of their favorite sources. Hundreds are named, as reflected in the high and growing preference for specialized marine electronics shops above, but of course a few are named a lot. Below is an update of the most-cited list generated early in the 2010 survey. No surprise that long-time online discounter Defender and surviving national chain West Marine dominate, but I think it's interesting that essentially regional operations like Hamilton (Maine) and Fisheries Supply (Washington) do so well. Maybe marine electronics really is a "cottage industry"? -- Ben

Share

Share

One thing you didn't mention is commoditization. From what I've seen, as new tech slides across the hype cycle from over-rated and under-performing to a generally reliable commodity, buyers move their purchasing from new tech boutique suppliers to the commodity houses as soon as possible.

The second aspect of commoditization is the disappearance of end user maintainability. Thirty years ago a local technician with a modest bench could fix a radar. Today one either trashes it for a new one or sends it back to the manufacturer who trashes it and sends a new one or new guts in the old case. $3000-$4000 electronic devices have become no more maintainable than cell phones, so people buy on price and the channel that sells lowest with the best return policy generally wins.